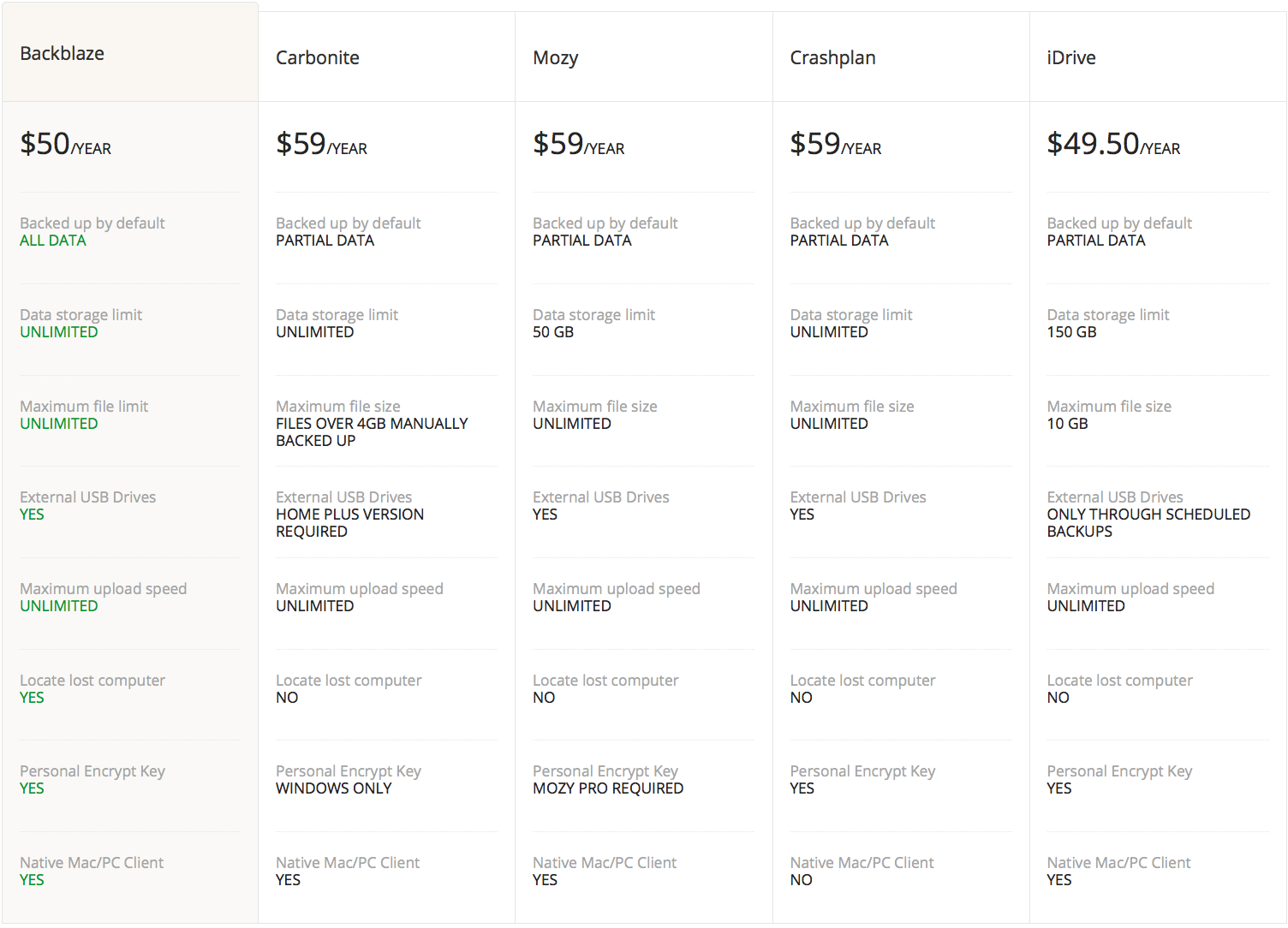

So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast). You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).īut note: Backblaze may not be the best stock to buy. However, that's in the past now, and it's the future that matters most. You might even wonder if the share price was previously over-hyped. Unfortunately that wasn't good enough to stop the share price dropping 31%.

That's definitely a respectable growth rate. In the last twelve months, Backblaze increased its revenue by 24%.

Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. So let's do just that.Ĭheck out our latest analysis for Backblazeīackblaze isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. Furthermore, it's down 24% in about a quarter. Because Backblaze hasn't been listed for many years, the market is still learning about how the business performs. That's well below the market decline of 1.0%.

( NASDAQ:BLZE) shareholders over the last year, as the share price declined 31%. That downside risk was realized by Backblaze, Inc.

Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market.

0 kommentar(er)

0 kommentar(er)